ARE YOU READY TO DITCH THE TENANTS AND TOILETS?

DISCOVER THE EXACT STRATEGY WE ARE USING TO HELP OWNERS DITCH THE HASSLES OF TRADITIONAL REAL ESTATE PROPERTIES FOR TRUE PASSIVE INCOME.

WATCH THIS VIDEO NOW

Learn How Real Estate Investors are Ditching Doors for Deeds...and earning REAL passive income every month.

ARE YOU READY TO DITCH THE TENANTS AND TOILETS?

DISCOVER THE EXACT STRATEGY WE ARE USING TO HELP OWNERS DITCH THE HASSLES OF TRADITIONAL REAL ESTATE PROPERTIES FOR TRUE PASSIVE INCOME.

WATCH THIS VIDEO NOW

Learn How Real Estate Investors are Ditching Doors for Deeds...and earning REAL passive income every month.

SWAP OUT BAD TENANTS FOR THE COUNTRIES PREMIER ENERGY PRODUCERS

HERE IS THE TRUTH

Owning Rental Properties Is Not Passive...

You were promised mailbox money. What you got was a second job.

Let’s be honest—most real estate “investments” feel more like another hustle.

✔️ Midnight maintenance calls

✔️ Vacancies that cost you thousands

✔️ Tenants who treat your property like a short-term hotel

✔️ Endless paperwork, taxes, and headaches

This isn’t passive income—it’s active management.

And when you factor in inflation, rising insurance, and local regulation?

You start asking yourself, “Is this really worth it?”

There’s a smarter way to generate consistent, hands-off income from real property…

But you won’t hear about it from the mainstream gurus.

TRUE PASSIVE INCOME IS POSSIBLE

BUT...It's Not What You Have Been Taught By Real Estate "GURUS"

Forget fixing roofs or chasing rent checks. There’s an asset class most investors never consider… but should.

What if you could:

✅ Own real estate — without managing it

✅ Generate monthly cash flow — without tenants

✅ Get paid like a landlord — without acting like one

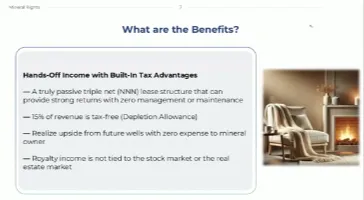

That’s what mineral rights offer.

You own the subsurface deed. Energy companies do the work.

You collect revenue based on what they produce.

No taxes. No insurance. No maintenance. No management.

Just ownership that pays you… while you sleep.

This is the most passive real estate you’ve never heard of.

SAY GOODBYE TO PROPERTY TAXES AND TOILETS...

And Say Hello To Maintenance Free Mailbox Money

Why deal with the headaches when you can own something smarter?

When you buy mineral rights, you don’t:

🚫 Pay property taxes

🚫 Worry about broken toilets

🚫 Deal with leases, evictions, or HOAs

🚫 Carry insurance

🚫 Chase rent payments

Your “tenants” are oil and gas operators.

They drill. They extract. You get paid.

Think of it as the ultimate triple-net lease.

Except there’s no building. Just deeded ownership — and pure passive income.

START CASHING IN ON THIS LITTLE KNOWN STRATEGY

No Tenants, No Toilets, No Surprises

We’ve helped investors like you quietly reposition into a better asset — with fewer headaches and better returns.

Real estate made you believe the only path to wealth was doors.

But the smart money knows better.

By rolling capital into mineral rights — especially through a 1031 exchange or tax-advantaged structure — investors unlock:

✅ Monthly royalty income

✅ Truly passive ownership

✅ Deferred taxes

🧭 Long-term wealth preservation

This isn’t theory.

We’re already helping investors do it — and the best part?

You don’t need to be an oil expert. You just need the right partner.

FIND OUT WHY PEOPLE LIKE YOU ARE CHOOSING US

Measure Us Not by Our Words, but by Our Deeds.

We’re not selling hype. We’re sourcing real mineral deals and helping investors build long-term wealth the smarter way.

True Turnkey Ownership

We source, vet, and structure mineral rights acquisitions so you don’t have to. Everything is reviewed for viability, operator strength, and long-term yield.

Built for Cash Flow + Capital Preservation

We help clients create steady revenue streams while protecting their capital with asset-backed ownership that works in bull or bear markets.

Strategic Guidance, Not a Sales Pitch

We’re educators and guides, not gurus. If it’s not a fit for your portfolio, we’ll tell you. If it is, we’ll show you how to capitalize.

SWAP OUT BAD TENANTS FOR THE COUNTRIES PREMIER ENERGY PRODUCERS

HERE IS THE TRUTH

Owning Rental Properties Is Not Passive...

You were promised mailbox money. What you got was a second job.

Let’s be honest—most real estate “investments” feel more like another hustle.

✔️ Midnight maintenance calls

✔️ Vacancies that cost you thousands

✔️ Tenants who treat your property like a short-term hotel

✔️ Endless paperwork, taxes, and headaches

This isn’t passive income—it’s active management.

And when you factor in inflation, rising insurance, and local regulation?

You start asking yourself, “Is this really worth it?”

There’s a smarter way to generate consistent, hands-off income from real property…

But you won’t hear about it from the mainstream gurus.

TRUE PASSIVE INCOME IS POSSIBLE

BUT...It's Not What You Have Been Taught By Real Estate "GURUS"

Forget fixing roofs or chasing rent checks. There’s an asset class most investors never consider… but should.

What if you could:

✅ Own real estate — without managing it

✅ Generate monthly cash flow — without tenants

✅ Get paid like a landlord — without acting like one

That’s what mineral rights offer.

You own the subsurface deed. Energy companies do the work.

You collect revenue based on what they produce.

No taxes. No insurance. No maintenance. No management.

Just ownership that pays you… while you sleep.

This is the most passive real estate you’ve never heard of.

SAY GOODBYE TO PROPERTY TAXES AND TOILETS...

And Say Hello To Maintenance Free Mailbox Money

Why deal with the headaches when you can own something smarter?

When you buy mineral rights, you don’t:

🚫 Pay property taxes

🚫 Worry about broken toilets

🚫 Deal with leases, evictions, or HOAs

🚫 Carry insurance

🚫 Chase rent payments

Your “tenants” are oil and gas operators.

They drill. They extract. You get paid.

Think of it as the ultimate triple-net lease.

Except there’s no building. Just deeded ownership — and pure passive income.

START CASHING IN ON THIS LITTLE KNOWN STRATEGY

No Tenants, No Toilets, No Surprises

We’ve helped investors like you quietly reposition into a better asset — with fewer headaches and better returns.

Real estate made you believe the only path to wealth was doors.

But the smart money knows better.

By rolling capital into mineral rights — especially through a 1031 exchange or tax-advantaged structure — investors unlock:

✅ Monthly royalty income

✅ Truly passive ownership

✅ Deferred taxes

🧭 Long-term wealth preservation

This isn’t theory.

We’re already helping investors do it — and the best part?

You don’t need to be an oil expert. You just need the right partner.

FIND OUT WHY PEOPLE LIKE YOU ARE CHOOSING US

Measure Us Not by Our Words, but by Our Deeds.

We’re not selling hype. We’re sourcing real mineral deals and helping investors build long-term wealth the smarter way.

True Turnkey Ownership

We source, vet, and structure mineral rights acquisitions so you don’t have to. Everything is reviewed for viability, operator strength, and long-term yield.

Built for Cash Flow + Capital Preservation

We help clients create steady revenue streams while protecting their capital with asset-backed ownership that works in bull or bear markets.

Strategic Guidance, Not a Sales Pitch

We’re educators and guides, not gurus. If it’s not a fit for your portfolio, we’ll tell you. If it is, we’ll show you how to capitalize.

A Smarter Conversation About Ownership Begins Here

Key Real Estate Consulting isn’t another investment firm chasing the trend of the week.

We help sophisticated investors understand and acquire real assets that deliver consistent, passive income — with none of the baggage that comes with traditional real estate.

Our mission is to simplify the complex, protect your downside, and put you in control of an asset that does what it’s supposed to do: pay you.

If you’ve been looking for a better answer… this is it.

A Smarter Conversation About Ownership Begins Here

Key Real Estate Consulting isn’t another investment firm chasing the trend of the week.

We help sophisticated investors understand and acquire real assets that deliver consistent, passive income — with none of the baggage that comes with traditional real estate.

Our mission is to simplify the complex, protect your downside, and put you in control of an asset that does what it’s supposed to do: pay you.

If you’ve been looking for a better answer… this is it.