How Smart Real Estate Investors and Family Offices Are Ditching the Headaches

WATCH THIS VIDEO NOW

Learn How Real Estate Investors are Ditching Doors for Deeds...and earning REAL passive income every month.

How Smart Real Estate Investors and Family Offices Are Ditching the Headaches

WATCH THIS VIDEO NOW...CLICK VIDEO FOR SOUND

SWAP OUT BAD TENANTS FOR THE COUNTRIES PREMIER ENERGY PRODUCERS

The Unfiltered Truth

Whether you’re a real estate investor, broker, agent, estate planner, fund manager, or family office advisor, you’ve seen how quickly active income turns into active stress.

You hustle to stack assets, but behind every deal is another fire to put out:

🕒 Late-night maintenance

💸 Vacancies and steep property taxes killing returns

📑 Seemingly endless paperwork

📞 Tenants treating properties like weekend crash pads

🔒 Local regulations tying your hands

Even the sharpest portfolios are taking hits from inflation, rising insurance costs, and nonstop compliance issues.

The real question is simple. What are you building, and is it really worth it?

There is a better play. A leaner asset. A smarter path to cashflow.

Most people never hear about it.

Passive Cashflow Exists

You Just Haven’t Been Shown This Version

Forget what the gurus sold you. Forget fixing roofs and chasing checks.

Let’s talk about ownership that actually works.

What if you could:

✅ Own real, deeded property

✅ Receive tax-advantaged cashflow every single month

✅ Skip the tenants, repairs, and micromanagement

This is the power of mineral rights.

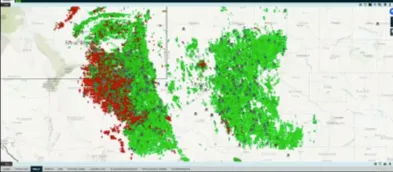

You own the deed to the subsurface. The mineral rights.

Energy companies extract the resources.

You collect monthly income tied directly to production.

No traditional property taxes*. No maintenance. No management headaches.

Just real estate ownership that finally acts like it.

No Tenants. No Toilets. No Trash.

Own Smarter. Earn Smoother. Sleep Better.

Add mineral rights to your strategy and remove the drag:

🚫 No traditional property tax*

🚫 No busted plumbing or broken HVAC

🚫 No tenants, evictions, or lease drama

🚫 No insurance premiums

🚫 No HOA or bureaucratic red tape

Your “tenants” are multi-billion-dollar oil and gas companies.

Think household names like Exxon, Chevron, ConocoPhillips, etc.

They drill. They produce. You get paid.

Think of it as the ultimate triple-net lease.

Only there’s no structure, no overhead, and no excuses.

Just deeded asset-backed cashflow that keeps hitting your account.

Optimize 1031s Without the Stress

If you’re looking for a smart, no-headache asset to optimize a 1031 exchange, especially to allocate leftover boot money, mineral rights are a clean solution.

You are not limited to low-yielding Delaware Statutory Trusts (DSTs) with painful lock-in periods.

We help real estate professionals and their clients place excess proceeds into performing assets that eliminate the usual headaches.

Deferred capital gains taxes. Real ownership. Monthly income. All without buying another door or taking on more management.

The Quiet Wealth Play Smart Professionals Are Making

Real estate investors. Family offices. RIAs. Estate planners. Top-producing agents.

They’re not chasing the next flip. They’re not gambling on appreciation.

They’re rolling into mineral rights and locking in:

💰 Monthly royalty income

🛠 True passive ownership

📉 Deferred taxes through 1031

📈 Long-term wealth preservation backed by energy production

You do not need to be an oil expert.

You just need the right guide to open the door.

Put Retirement Capital to Work in Real Assets That Actually Perform

Deeded Mineral Rights Are Compatible with Self-Directed IRAs and Solo 401(k)s

Forget what the gurus sold you. Forget fixing roofs and chasing checks.

If you or your clients are sitting on idle retirement funds inside a Self-Directed IRA or Solo 401(k), this is the kind of real asset that can finally go to work.

You are not limited to Wall Street overpriced real estate syndications

You can use qualified retirement dollars to acquire deeded, income-producing mineral rights. These assets can be held inside your self-directed retirement plan, allowing you to benefit from all the tax-deferred or tax-free advantages you’re already set up to receive.

What you get:

✅ Monthly royalty income paid directly to your retirement account

✅ No management responsibilities

✅ No debt or leverage required

✅ No tenant exposure or maintenance headaches

✅ Real ownership of a hard asset inside a tax-advantaged structure

Whether you’re managing client portfolios or repositioning your own, mineral rights offer a clean and tax-advantaged way to create income and preserve wealth inside a retirement plan.

This is not a theory. This is what we are helping real estate professionals, advisors, and high-net-worth families execute right now with the right custodians and the right structure.

No Hype. No Gimmicks. Just Deeds That Perform

Why the Professionals Trust Key Real Estate Consulting

Turnkey Ownership Without the Guesswork

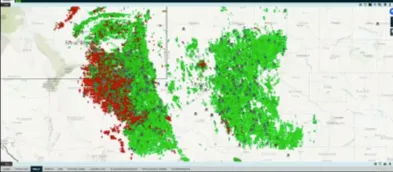

We vet and deliver high-quality mineral rights based on operator strength, production outlook, and yield.

Cashflow Meets Capital Protection

Every property is set to produce monthly revenue while securing your capital inside a real, tangible asset.

We Advise, We Don’t Push

If it’s not a fit, we will say so. If it is, we will show you exactly how to capitalize.

SWAP OUT BAD TENANTS FOR THE COUNTRIES PREMIER ENERGY PRODUCERS

The Unfiltered Truth

Whether you’re a real estate investor, broker, agent, estate planner, fund manager, or family office advisor, you’ve seen how quickly active income turns into active stress.

You hustle to stack assets, but behind every deal is another fire to put out:

🕒 Late-night maintenance

💸 Vacancies and steep property taxes killing returns

📑 Seemingly endless paperwork

📞 Tenants treating properties like weekend crash pads

🔒 Local regulations tying your hands

Even the sharpest portfolios are taking hits from inflation, rising insurance costs, and nonstop compliance issues.

The real question is simple. What are you building, and is it really worth it?

There is a better play. A leaner asset. A smarter path to cashflow.

Most people never hear about it.

Passive Cashflow Exists

You Just Haven’t Been Shown This Version

Forget what the gurus sold you. Forget fixing roofs and chasing checks.

Let’s talk about ownership that actually works.

What if you could:

✅ Own real, deeded property

✅ Receive tax-advantaged cashflow every single month

✅ Skip the tenants, repairs, and micromanagement

This is the power of mineral rights.

You own the deed to the subsurface. The mineral rights.

Energy companies extract the resources.

You collect monthly income tied directly to production.

No traditional property taxes*. No maintenance. No management headaches.

Just real estate ownership that finally acts like it.

No Tenants. No Toilets. No Trash.

Own Smarter. Earn Smoother. Sleep Better.

Add mineral rights to your strategy and remove the drag:

🚫 No traditional property tax*

🚫 No busted plumbing or broken HVAC

🚫 No tenants, evictions, or lease drama

🚫 No insurance premiums

🚫 No HOA or bureaucratic red tape

Your “tenants” are multi-billion-dollar oil and gas companies. Think household names like Exxon, Chevron, ConocoPhillips, etc.

They drill. They produce. You get paid.

Think of it as the ultimate triple-net lease.

Only there’s no structure, no overhead, and no excuses.

Just deeded asset-backed cashflow that keeps hitting your account.

Optimize 1031s Without the Stress

If you’re looking for a smart, no-headache asset to optimize a 1031 exchange, especially to allocate leftover boot money, mineral rights are a clean solution.

You are not limited to low-yielding Delaware Statutory Trusts (DSTs) with painful lock-in periods.

We help real estate professionals and their clients place excess proceeds into performing assets that eliminate the usual headaches.

Deferred capital gains taxes. Real ownership. Monthly income. All without buying another door or taking on more management.

The Quiet Wealth Play Smart Professionals Are Making

Real estate investors. Family offices. RIAs. Estate planners. Top-producing agents.

They’re not chasing the next flip. They’re not gambling on appreciation.

They’re rolling into mineral rights and locking in:

💰 Monthly royalty income

🛠 True passive ownership

📉 Deferred taxes through 1031

📈 Long-term wealth preservation backed by energy production

You do not need to be an oil expert.

You just need the right guide to open the door.

Put Retirement Capital to Work in Real Assets That Actually Perform

Deeded Mineral Rights Are Compatible with Self-Directed IRAs and Solo 401(k)s

If you or your clients are sitting on idle retirement funds inside a Self-Directed IRA or Solo 401(k), this is the kind of real asset that can finally go to work.

You are not limited to Wall Street overpriced real estate syndications

You can use qualified retirement dollars to acquire deeded, income-producing mineral rights. These assets can be held inside your self-directed retirement plan, allowing you to benefit from all the tax-deferred or tax-free advantages you’re already set up to receive.

What you get:

✅ Monthly royalty income paid directly to your retirement account

✅ No management responsibilities

✅ No debt or leverage required

✅ No tenant exposure or maintenance headaches

✅ Real ownership of a hard asset inside a tax-advantaged structure

Whether you’re managing client portfolios or repositioning your own, mineral rights offer a clean and tax-advantaged way to create income and preserve wealth inside a retirement plan.

This is not a theory. This is what we are helping real estate professionals, advisors, and high-net-worth families execute right now with the right custodians and the right structure.

Why the Professionals Trust Key Real Estate Consulting

No Hype. No Gimmicks. Just Deeds That Perform

Turnkey Ownership Without the Guesswork

We vet and deliver high-quality mineral rights based on operator strength, production outlook, and yield.

Cashflow Meets Capital Protection

Every property is set to produce monthly revenue while securing your capital inside a real, tangible asset.

We Advise, We Don’t Push

If it’s not a fit, we will say so. If it is, we will show you exactly how to capitalize.

This is the Real Conversation About Ownership

Key Real Estate Consulting does not chase trends.

We work with professionals who are ready to level up and lead with clarity.

Whether you are guiding clients, managing your own portfolio, or solving for capital gains, we help you plug into a real asset that pays like it should.

If you’re tired of the noise, tired of the grind, and ready for a smarter path to monthly cashflow, let’s get to work.

This is the Real Conversation About Ownership

Key Real Estate Consulting does not chase trends.

We work with professionals who are ready to level up and lead with clarity.

Whether you are guiding clients, managing your own portfolio, or solving for capital gains, we help you plug into a real asset that pays like it should.

If you’re tired of the noise, tired of the grind, and ready for a smarter path to monthly cashflow, let’s get to work.

Copyright © 2025 All Rights Reserved.

Key Real Estate Consulting

* In Texas, deeded mineral properties do not incur traditional property taxes. Ad valorem taxes and others are incurred.

Disclaimer: Royalty income is not a fixed revenue stream and is subject to variable commodity prices and production volumes. Actual performance will vary. This is not a security, securitized, nor fractionalized investment or ownership. This is not financial nor tax advice. This content and any associated documents and videos are for general informational purposes only and does not constitute an offer to sell or a solicitation to buy.